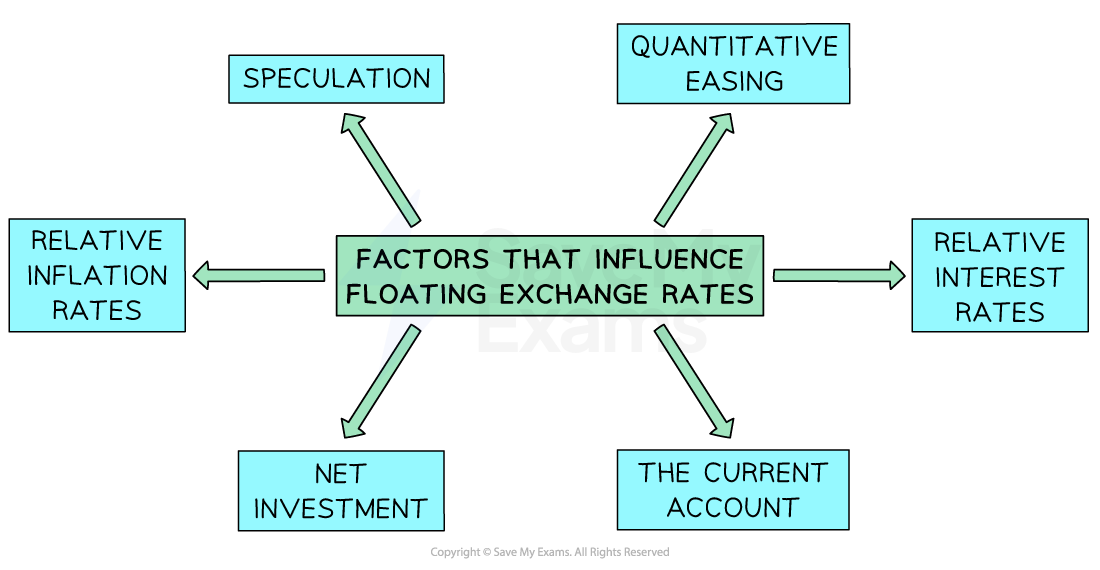

Causes of Exchange Rate Fluctuations

- Numerous factors influence floating exchange rates, resulting in an appreciation or depreciation of a currency

Factors influencing floating exchange rates

- Relative interest rates: influence the flow of hot money between countries. If the UK increases its interest rate, then demand for £'s by foreign investors increases and the £ appreciates. If the UK decreases its interest rate, then the supply of £'s increases as investors sell their £'s in favour of other currencies and the £ depreciates

- Relative inflation rates: as inflation in the UK rises relative to other countries, its exports become more expensive so there is less demand for UK products by foreigners, which means there is less demand for £s and so the £ depreciates

- Net foreign direct investment (FDI): FDI into the UK creates a demand for the £ which leads to the £ appreciating. FDI by UK firms abroad creates a supply of £'s which leads to the £ depreciating

- The current account: EU exports have to be paid for in €'s. EU imports have to be paid for in local currencies, which requires €'s to be supplied to the forex market. Due to this, an increasing net exports will result in an appreciation of the € and falling net exports will result in a depreciation of the €

- Changes in tastes/preferences: As global demand for quinoa increased as it became fashionable, Bolivia's exports of quinoa increased dramatically which put upward pressure on their currency. Foreigners demanded the Boliviano in order to pay for the quinoa

- Speculation: the vast majority of currency trades are speculative. Speculation occurs when traders buy a currency in the expectation that it will be worth more in the short to medium term, at which point they will sell it to realise a profit

- Net Portfolio Investment: Portfolio investment into the UK creates a demand for the £ which leads to the £ appreciating. Portfolio investment by UK firms abroad creates a supply of £'s which leads to the £ depreciating

- [popover id="RbhwpSYhQds6BEol" label="Remittances"]: Some countries receive high levels of remittances which help to keep the demand for their currency strong e.g. the Philippines

- Relative growth rates: Countries with stronger economic growth rates will attract higher levels of FDI resulting in an appreciation of their currency

- Central Bank intervention: Any form of monetary policy is likely to influence exchange rates e.g. higher interest rates will increase the hot money flows. Direct intervention using foreign reserves will also influence the exchange rate

Consequences of Foreign Exchange Rate Fluctuations

- Changes to exchange rates may have far-reaching impacts on an economy

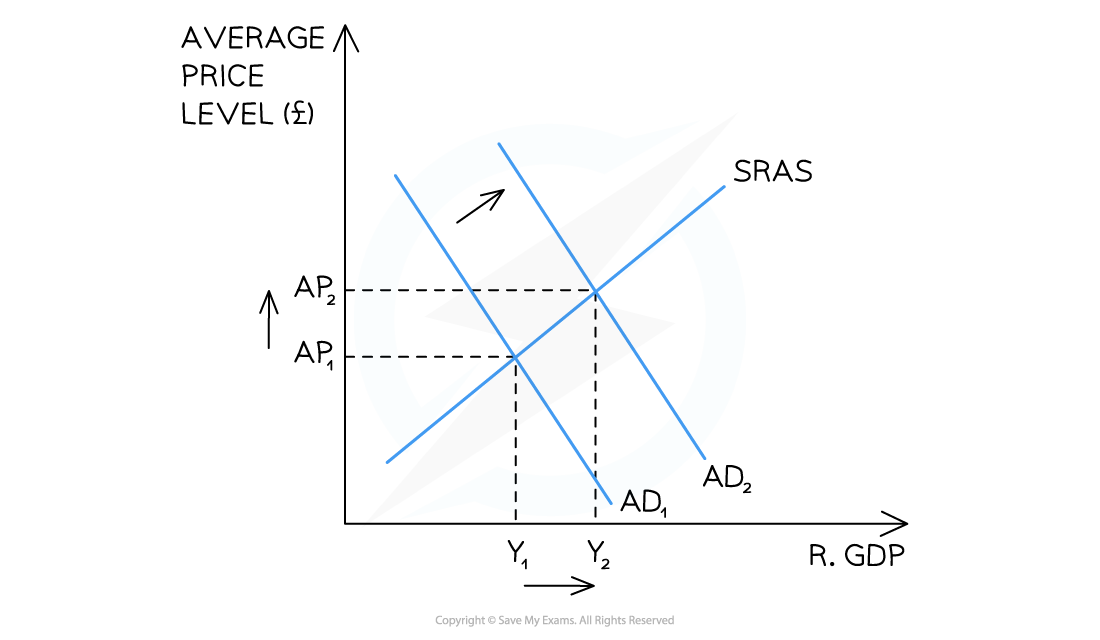

1. Likely impact on the macro economy of a currency depreciation

A depreciation means that imports are more expensive and exports are cheaper. Net exports should rise leading to an increase in AD from AD1 → AD2

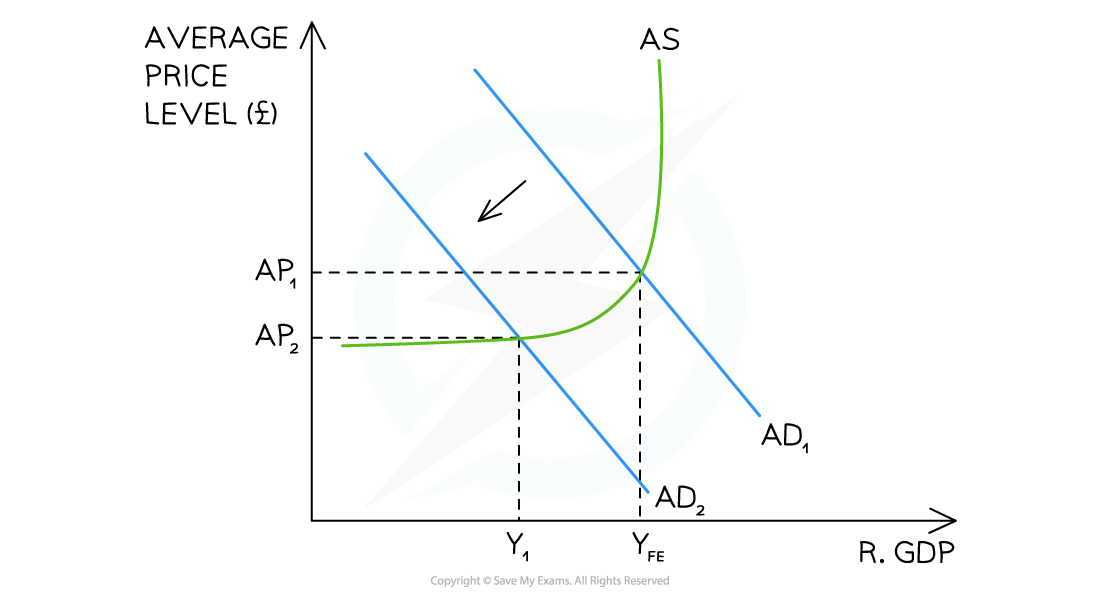

2. Likely impact on the macro economy of a currency appreciation

An appreciation means that imports are cheaper and exports are more expensive. Net exports should fall leading to a decrease in AD from AD1 → AD2

Impact of an Appreciation or Depreciation on the Economic Indicators

Economic Indicator |

Explanation |

|

The Current Account

|

|

|

Economic growth

|

|

|

Inflation

|

|

|

Unemployment

|

|

|

Living standards

|

|