PED & Total Revenue

- The total revenue rule states that in order to maximise revenue, firms should increase the price of products that are price inelastic in demand and decrease prices on products that are elastic in demand

- The benefits of this rule can be illustrated using a demand curve

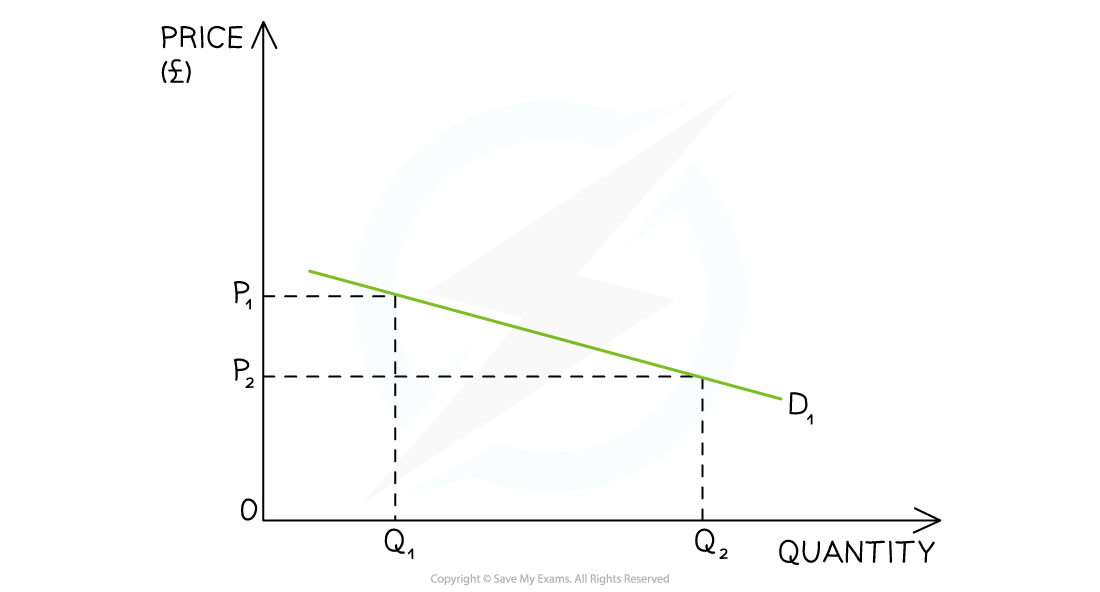

- A shallow curve represents a price-elastic product

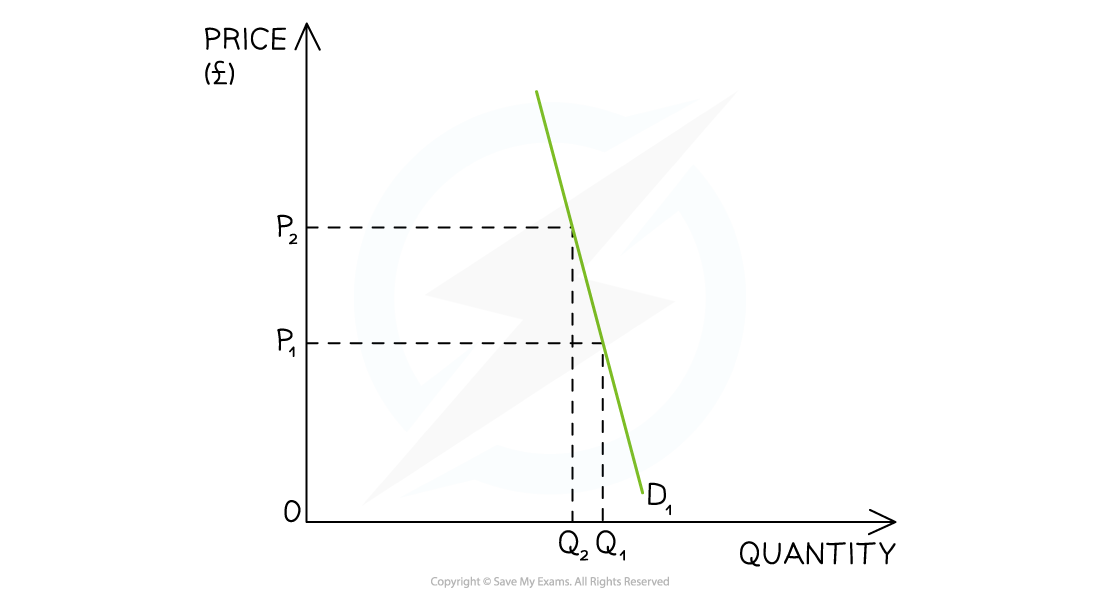

- A steep curve represents a price inelastic product

An illustration of price elastic demand where a small decrease in price from P1→P2 causes a large increase in quantity demanded from Q1→ Q2

Diagram Analysis

- When a good/service is price elastic in demand, there is a greater than proportional increase in the quantity demanded to a decrease in price

- A small decrease in price leads to a larger increase in QD

- TR is higher once the price has been decreased

An illustration of price inelastic demand where a large increase in price from P1→P2 causes a small decrease in quantity demanded from Q1→ Q2

Diagram Analysis

- When a good/service is price inelastic in demand, there is a smaller than proportional decrease in the quantity demanded to an increase in price

- A large increase in price leads to a smaller decrease in QD

- TR is higher once the price has been increased

The Implications of PED for Firms & Governments

- Knowledge of PED is important to firms seeking to maximise their revenue

- If their product is price inelastic in demand, they should raise their prices

- If price elastic in demand, then they should lower their prices

- Firms can choose to use price discrimination to maximise their revenue i.e. lower prices for certain segments and higher prices for others

- Knowledge of PED is important to Governments with regard to taxation and subsidies

- If governments tax price inelastic in-demand products, they can raise tax revenue without harming firms too much

- Consumers are less responsive to price changes so firms will pass on the tax to the consumer

- If Governments subsidise price elastic in demand products, there can be a greater than proportional increase in the quantity demanded

- This strategy is especially good for encouraging consumption of merit goods such as electric vehicles

- If governments tax price inelastic in-demand products, they can raise tax revenue without harming firms too much