Introduction to Demand-side Policies

- Demand-side policies aim to shift aggregate demand (AD) in an economy

- There are two categories of demand-side policies

- Fiscal policy and monetary policy

- Fiscal policy and monetary policy

- Fiscal policy involves the use of government spending and taxation to influence AD

- The government is responsible for setting fiscal policy

- Governments usually present their fiscal policies to the country each year when they deliver the Government budget

- Monetary policy involves adjusting interest rates and the money supply so as to influence AD

- Central Banks are usually responsible for setting monetary policy

- Central Bank committees usually meet 4-8 times a year to set policy

The Goals of Monetary Policy

- Monetary policy is used to help the government achieve their macroeconomic objectives

- Specifically, the use of monetary policy aims to achieve

- A low and stable rate of inflation

- Low unemployment

- Reduce business cycle fluctuations

- Promote a stable economic environment for long-term growth

- To control the level of exports and imports (net external balance)

- When a policy decision is made, it creates a ripple effect through the economy impacting the macroeconomic objectives of the government

Real Versus Nominal Interest Rates

- In economics, the use of the word nominal refers to the fact that the metric has not been adjusted for inflation

- The nominal interest rate is the headline rate presented by commercial banks

- There has been no adjustment to the interest rate based on the rate of inflation

- There has been no adjustment to the interest rate based on the rate of inflation

- The real interest rate is the nominal interest rate minus the rate of inflation

- For example, if the nominal interest rate for saving money at a commercial bank is 3% and inflation is 2% then the real interest rate is 1%

- The value of the savings is effectively increasing by only 1%

- The real interest rate can also be calculated using consumer price index (CPI) data

Worked Example

Using the data, calculate the real interest rate in 2021 [3 marks]

| Year | CPI | Nominal Interest rate |

| 2020 | 103.2 | - |

| 2021 | 105.9 | 4% |

Step 1: Calculate the inflation rate by calculating the % difference between the CPI for 2021 and 2020

Step 2: Calculate the real interest rate

Real interest rate = nominal interest rate - inflation rate

= 4% - 2.62%

= 1.38%

(3 marks for a correct answer or 1 mark for any correct working)

Monetary Policy Instruments

- The two main instruments of monetary policy include

- Incremental adjustments to the interest rate (usually not more than 0.25%)

- Quantitative easing which increases the supply of money in the economy

- The Central Bank creates new money and uses it to buy open-market assets such as bonds

- The Central Bank creates new money and uses it to buy open-market assets such as bonds

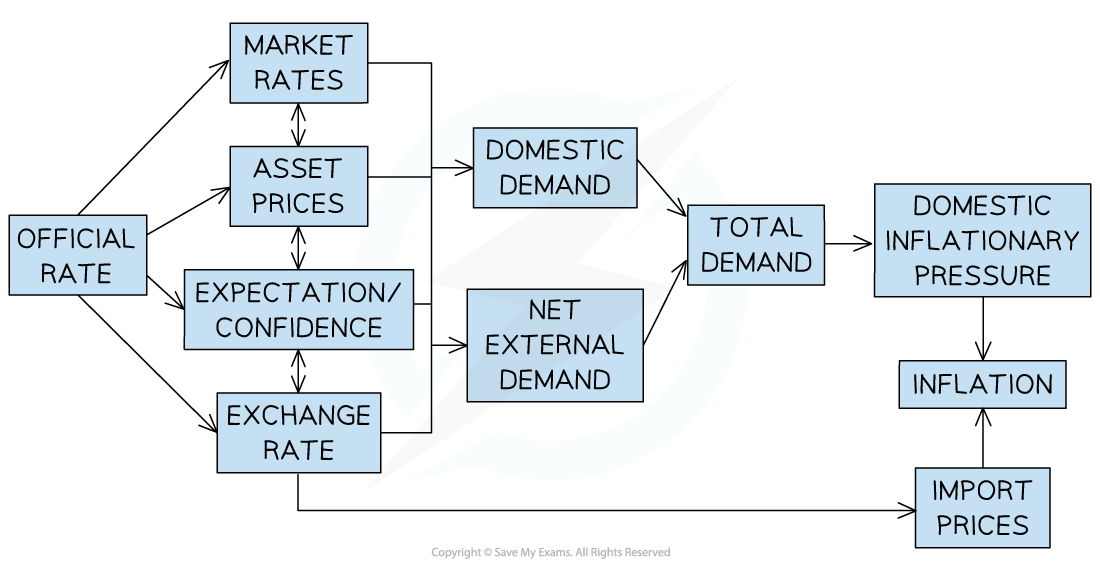

- When a policy decision is made, it creates a ripple effect through the economy and this effect is known as a transmission mechanism

Incremental Changes to Interest Rates

The transmission mechanisms of changes to the interest rate

Before Explaining a Mechanism from the Diagram Above, key Terminology can be Reviewed Below

| Official Rate | Market Rates | Asset Prices |

| Exchange Rate | Net External Demand | Inflation |

Example 1

- Official rate decreases by 0.25% → market rates decrease → loans are cheaper → consumers borrow more → consumption increases → AD increases → inflation increases

Example 2

- Official rate decreases by 0.25% → market rates decrease → mortgages are cheaper → property buyers borrow more → demand for houses increases → asset prices increase

Example 3

- Official rate decreases by 0.25% → market rates decrease → buyers borrow more → asset prices increase → households with assets feel wealthier → consumption increases → AD increases → inflation increases

Example 4

- Official rate increases by 0.25% → hot money flows increase → the exchange rate appreciates → exports more expensive and imports cheaper → net exports reduce → AD decreases → inflation decreases

Example 5

- Official rate increases by 0.25% → market rates increase → existing loan repayments now more expensive to repay → discretionary income falls → consumption decreases → AD decreases → inflation decreases

Quantitative Easing Transmission Mechanism

- The Bank of England commits to buy £60bn of gilts a month → commercial banks receive cash for their gilts → liquidity in the market increases → commercial banks lower lending rates → consumers and firms borrow more → consumption and investment increase → AD increases → inflation increases

Expansionary & Contractionary Monetary Policy

Expansionary Monetary Policy

- Monetary policy can be expansionary in order to generate further economic growth (also referred to as loose monetary policy)

- Expansionary policies include reducing interest rates, increasing QE, or depreciating the exchange rate

- Expansionary policies include reducing interest rates, increasing QE, or depreciating the exchange rate

- To understand the effects of monetary policy on an economy, it is useful to know how aggregate demand (AD) is calculated

- AD= household consumption (C) + firms investment (I) + government spending (G) + exports (X) - imports (M)

- AD = C + I + G + (X - M)

- From this, it is logical that changes to monetary policy can influence any of these components - and often several of them at once

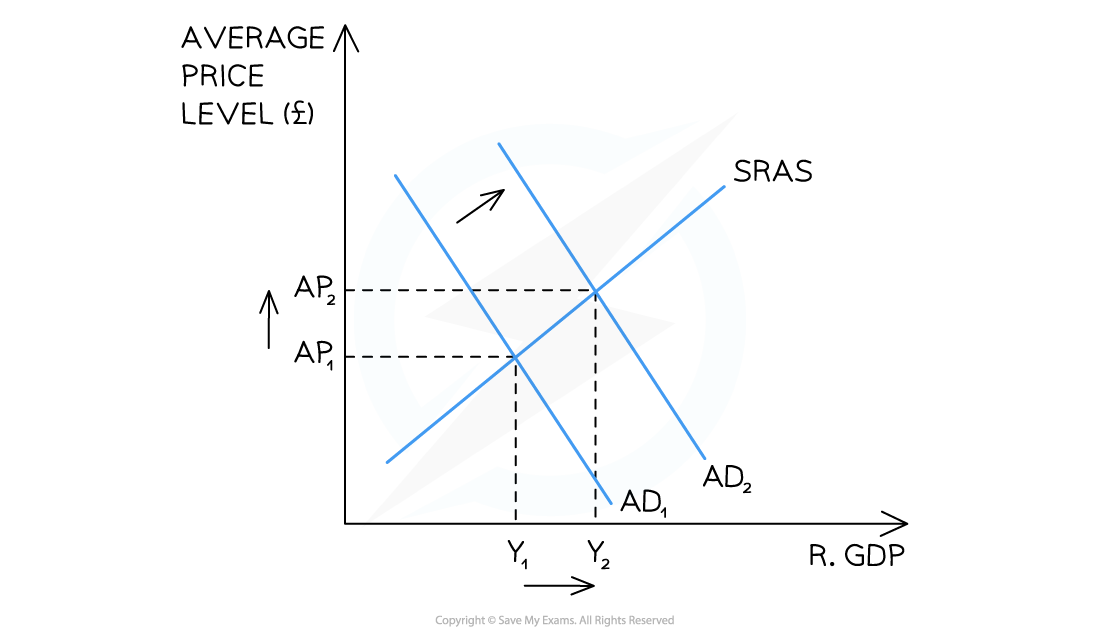

- Expansionary monetary policy aims to shift aggregate demand (AD) to the right

Classical diagram illustrating expansionary monetary policy which increases real GDP (Y1 →Y2) and average price levels (AP1 →AP2)

Diagram Analysis

- The economy is initially in macroeconomic equilibrium AP1Y1

- The Central Bank is wanting to boost economic growth and lowers interest rates

- Lower interest rates cause investment and consumption to increase which are components of AD

- Aggregate demand increases from AD1→ AD2

- The economy reaches a new equilibrium at AP2Y2 - a higher average price level and a greater level of national output

An Example of how Expansionary Monetary Policy Impacts on the Goals

|

|

|

|

Effect on the economy |

|

|

Impact on macroeconomic aims |

|

Contractionary Monetary Policy

- Monetary policy can be contractionary in order to slow down economic growth or reduce inflation (also referred to as tight monetary policy)

- Contractionary policies include increasing interest rates, decreasing/stopping QE, or appreciating the exchange rate

- Contractionary policies include increasing interest rates, decreasing/stopping QE, or appreciating the exchange rate

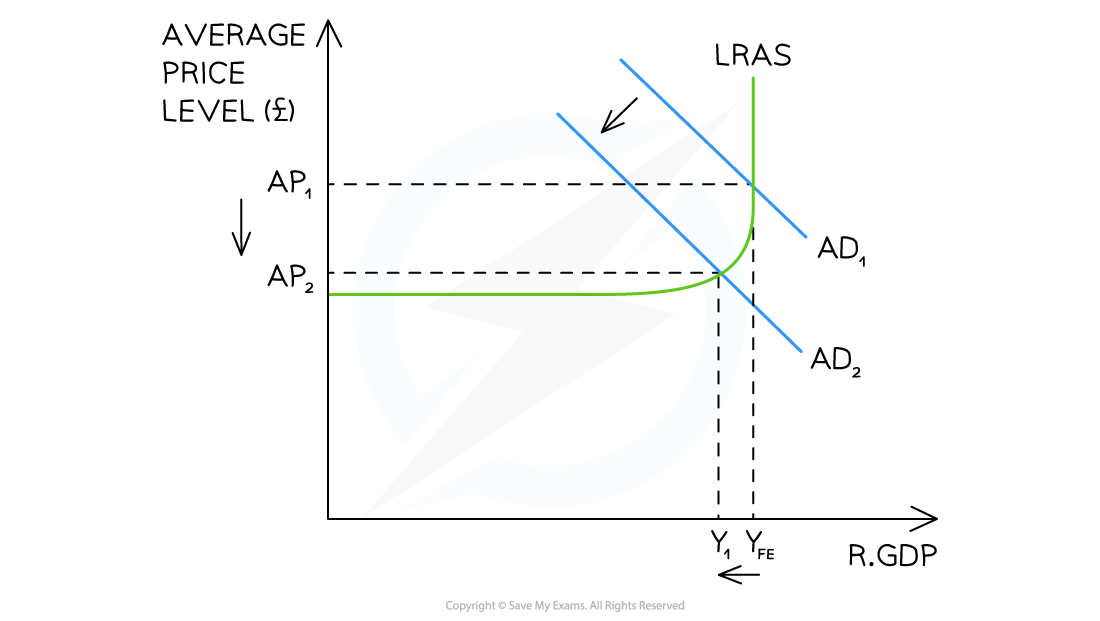

- Contractionary monetary policy aims to shift aggregate demand to the left

Keynesian diagram illustrating contractionary monetary policy which decreases the real GDP (YFE →Y1) and average price levels (AP1 →AP2)

Diagram Analysis

- The economy is initially in macroeconomic equilibrium AP1YFE

- The Central Bank is wanting to lower inflation towards its target of 2% - and increases interest rates

- Higher interest rates cause investment and consumption to decrease

- Aggregate demand decreases from AD1→ AD2

- The economy reaches a new equilibrium at AP2Y1 - a lower average price level and a smaller level of national output

An Example of how Contractionary Monetary Policy Impacts on the Goals

|

|

|

|

Effect on the economy |

|

|

Impact on macroeconomic aims |

|

Exam Tip

When analysing monetary policy, it is worth noting that monetary policy (4-8 x per year) can be adjusted more quickly than fiscal policy (usually once per year). However, the impact of fiscal policy is more predictable than the impact of monetary policy. For example, households may not borrow more money if their confidence in the economy is low - irrespective of how low interest rates go.

An Evaluation of Monetary Policy

Strengths of Monetary Policy

- Central Banks can operate independently from the Government (political process)

- Central Banks can consider the long-term outlook

- Contractionary policy is often effective when there is an inflationary gap

- Targets inflation and maintains stable prices

- Depreciating the currency can increase exports

- The frequency of policy alterations (4-8 times per year) allows for constant adjustments to macroeconomic variables

Weaknesses of Monetary Policy

- Conflicting goals e.g economic growth puts upward pressure on inflation

- Expansionary policy is less effective during a deflationary gap

- The larger the output gap the less effective it can be

- Consumers may not respond to lower interest rates when confidence is low

- Time lags between policy and the desired impact (up to 2 years)

- During particularly bad recessions, the impact of expansionary policy may take some time to be seen in the economy

- Expansionary policy leads to cheaper credit which can inflate asset prices (houses) in the long term

- The interest rate has limitations on downward adjustment

- The closer it gets to zero the less effective changes are