An Introduction to Inflation

- Inflation is the sustained increase in the average price level of goods/services in an economy

- Deflation occurs when there is a fall in the average price level of goods/services in an economy

- Deflation only occurs when the percentage change in prices falls below zero %

- Deflation only occurs when the percentage change in prices falls below zero %

- Disinflation occurs when the average price level is still rising, but at a lower rate than before

- These figures demonstrate disinflation: Y1 = 5% Y2 = 4% Y3 = 2%

- Inflation is increasing but at a decreasing rate

- These figures demonstrate disinflation: Y1 = 5% Y2 = 4% Y3 = 2%

Worked Example

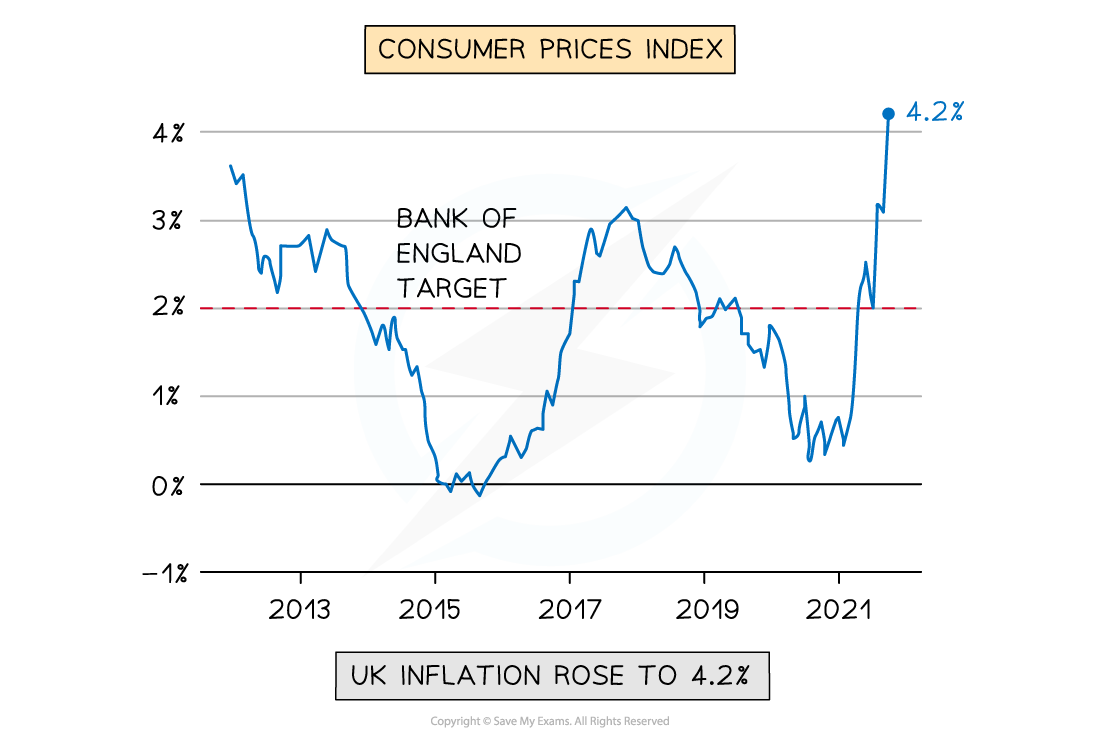

How would you characterise the fall in the CPI from 2018 to 2021? Explain your answer [3]

Step 1: Study the time period and decide if you are witnessing inflation, disinflation or deflation

Disinflation (1 mark)

Step 2: Explain your answer

According to the CPI data, prices are still rising but at a decreasing rate. For example, in 2018 prices were rising at around 3%. In 2019 this increase fell to roughly 1.8%. In 2021, they were still rising but by a much lower 0.5%

(2 marks for an answer with a correct explanation which references the data)

Measuring Inflation Using the Consumer Price Index (CPI)

- Inflation is the sustained increase in the average price level of goods/services in an economy

- The average price level is measured by checking the prices of a 'basket' of goods/services that an average household will purchase each month

- This basket of goods is turned into an index and it is called the consumer price index (CPI)

- Many economies have an inflation target of 2% per annum

- Low inflation is better than no inflation as it is a sign of economic growth

- Low inflation is better than no inflation as it is a sign of economic growth

- The inflation rate is the change in average price levels in a given time period

- The inflation rate is calculated using an index with 100 as the base year

- If the index is 100 in year 1 and 107 in year 2 then the inflation rate is 7%

The Consumer Price Index (CPI)

- A 'household basket' of goods/services that an average family would purchase is compiled on an annual basis

- A household expenditure survey is conducted to determine what goes into the basket

- Each year, some goods/services exit the basket and new ones are added

- The number of goods in the basket varies from country to country e.g. the UK has 700 'goods' in their basket and Singapore has 4,800

- Goods/services in the basket are weighted based on the proportion of household spending

- E.g. More money is spent on food than shoes, so shoes have a lower weight in the basket

- E.g. More money is spent on food than shoes, so shoes have a lower weight in the basket

- Each month, prices for these goods/services are gathered from many locations across the country

- These prices are averaged out

- These prices are averaged out

- The price x the weighting determines the final value of the good/service in the basket

- These final values are added together to determine the price of the 'basket'

- These final values are added together to determine the price of the 'basket'

- The percentage difference in CPI between the two years is the inflation rate for the period

Worked Example

Using the information in the table, calculate the inflation rate for 2021 if the price of the basket in the base year (2019) was $400 [3]

| Good | Price 2020 | Price 2021 | Weight |

Basket 2020 (Price x weight) |

Basket 2021 (Price x weight) |

| Housing, water, electricity, gas | 950 | 1200 | 34% | 323.00 | 408.00 |

| Transport | 250 | 325 | 11% | 27.50 | 35.75 |

| Food | 500 | 620 | 9% | 45.00 | 55.80 |

| Recreation and culture | 300 | 340 | 10% | 30.00 | 34.00 |

| Clothing and footwear | 190 | 210 | 5% | 9.50 | 10.50 |

| $435.00 | $544.05 |

Step 1: Calculate the CPI for 2020

Step 2: Calculate the CPI for 2021

Step 3: Calculate the percentage difference between the CPI for 2021 and 2020

(3 marks for the correct answer or 1 mark for any correct working. Answers should be rounded to 2 decimal places to be correct)

The Limitations of Using the CPI

- The CPI provides a level of inflation for the average basket and the basket of many households is not the average basket

- Depending on what households buy the level of inflation for each one can vary significantly

- As an average, it also ignores regional differences in inflation e.g. London's inflation may be much higher than Manchester's inflation

- The CPI is one of several methods used by countries in determining inflation - another is the retail price index (RPI)

- This can make comparisons between countries less meaningful as one may use the RPI and another the CPI

- This can make comparisons between countries less meaningful as one may use the RPI and another the CPI

- The CPI does not capture the quality of the products in the basket

- Product quality changes over time and so the comparison with different time periods is less useful

- Product quality changes over time and so the comparison with different time periods is less useful

- The CPI only measures changes in consumption on an annual basis

- Changes in consumption can occur more frequently and the index is always behind these changes

- Changes in consumption can occur more frequently and the index is always behind these changes

- The CPI is prone to errors in data collection

- It is based on a survey that goes to thousands of households each year, yet it is still a small sample

- The respondents have no incentive to fill in the survey carefully and accurately

The Causes of Inflation

- An increase in the average prices in an economy can be caused by demand pull inflation or cost push inflation

1. Demand Pull Inflation

- Demand pull inflation is caused by excess demand in the economy

- Aggregate demand (AD) is the sum of all expenditure in the economy

- AD = Consumption (C) + Investment (I) + Government spending (G) + Net Exports (X-M)

An increase in aggregate demand (AD) raises the average price level in an economy leading to demand pull inflation

Diagram Analysis

- If any of the four components of AD increase (ceteris paribus), there will be a shift to the right of the AD curve from AD1 → AD2

- At the original price (AP1), there is now a condition of excess demand in the economy

- As prices rise, there is a contraction of AD and an extension of SRAS

- Prices for goods/services are bid up from AP1 → AP2

- Demand pull inflation has occurred

- If the Central Bank lowers the base rate, there is likely to be increased borrowing by firms and consumers

- This will result in an increase in consumption and investment

- It is likely to lead to a form of demand-pull inflation

2. Cost Push Inflation

- Cost push inflation is caused by increases in the costs of production in an economy

An increase in the costs of production raises the average price level in an economy leading to cost push inflation

Diagram Analysis

- If any of the costs of production increase (labour, raw materials etc.), or if there is a fall in productivity, there will be a shift to the left of the SRAS curve from SRAS1→SRAS2

- At the original price (AP1), there is now a condition of excess demand in the economy

- As prices rise, there is a contraction of AD and an extension of SRAS

- Prices for goods/services are bid up from AP1→AP2

- Cost push inflation has occurred

The Costs of Inflation

The Impact of Inflation on Different Stakeholders

Stakeholder |

Explanation of Impact |

|

Firms |

|

|

Consumers |

|

|

Government |

|

|

Workers |

|

The Causes and Costs of Deflation

- Deflation occurs when there is a fall in the average price level of goods/services in an economy as measured by the consumer price index (CPI)

- Deflation only occurs when the percentage change in prices falls below zero %

- Deflation only occurs when the percentage change in prices falls below zero %

- Deflation can be caused by either demand-side or supply-side factors

- The two different causes of deflation have very different consequences for the economy

- The two different causes of deflation have very different consequences for the economy

1. Demand-side Deflation (Bad Deflation)

- Demand-side deflation is caused by a fall in total (aggregate) demand in the economy

- Aggregate demand is the sum of all expenditures in the economy as measured by the real gross domestic product (rGDP)

- rGDP = Consumption (C) + Investment (I) + Government spending (G) + Net Exports (X-M)

- If any of the four components of rGDP decrease, there will possibly be a decrease in the aggregate demand in the economy leading to a decrease in the general price level

- Demand-side deflation has occurred

Aggregate demand (AD) has fallen leading to a reduction in the average price level (AP)

Diagram Analysis

- The initial macroeconomic equilibrium is at AP Y

- Any factor which causes a reduction in one or more of the determinants of real GDP may cause the AD curve to shift left from AD1 → AD2

- This shift causes a fall in average price levels from AP to AP1

- The new macroeconomic equilibrium is now at AP1 Y1

- Demand-side deflation has occurred

The Consequences of Demand-side Deflation

Government Challenges |

Consumers Lose Confidence |

Debt |

|

|

|

Firms Lose Confidence |

Bankruptcies |

Exports |

|

|

|

2. Supply-side Deflation

- Supply-side deflation is caused by increases in the productive capacity of the economy

- This is brought about by any increase in the quantity/quality of the factors of production

- It effectively creates a condition of excess supply in the economy

- Average price levels fall

- National output (rGDP) increases

Short-run aggregate supply (SRAS) has increased leading to a reduction in the average price level (AP)

Diagram Analysis

- The initial macroeconomic equilibrium is at AP Y

- Any factor which causes an increase in the SRAS will result in the SRAS curve shifting right from SRAS → SRAS1

- This shift causes a fall in average price levels from AP → AP1

- The new macroeconomic equilibrium is now at AP1 Y1

- Supply-side deflation has occurred

The Consequences of Supply-side Deflation

Unemployment |

Consumers Gain Confidence |

Debt |

|

|

|

Firms Gain Confidence |

Exports |

|

|

|

Exam Tip

Understanding the cause of deflation is vital to analysing the consequences of the deflation.

Falling prices caused by a recession are not good for an economy. In this scenario, national output is falling which means that fewer workers will be required to produce goods/services so unemployment will increase.

Falling prices caused by an increase in supply are good for an economy. In this scenario, national output is rising which means that more workers will be required to produce goods/services so unemployment will decrease.

The Relative Costs of Unemployment Versus Inflation

- Generally, there is an inverse relationship between inflation and unemployment

- When inflation increases unemployment decreases and vice versa

- Each situation has consequences for the economy and governments try to limit the negative consequences

The Costs of Unemployment Versus Inflation

Unemployment |

Inflation |

|

|

Exam Tip

When analysing inflation in data response questions, or evaluating it in longer essay questions, make certain that you consider the size of any inflation. Low Inflation is not bad but is actually a sign of a healthy economy as it is indicative of economic growth.