Reasons why Governments Intervene

- Nearly every economy in the world is a mixed economy & has varying degrees of government intervention

- Governments intervention is necessary for several reasons

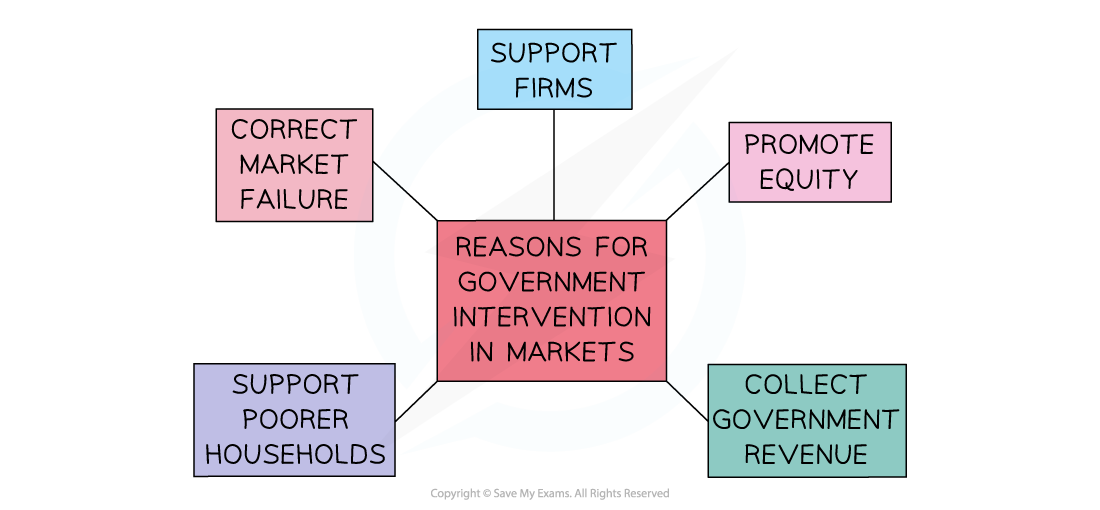

A diagram showing several reasons for government intervention in mixed economic systems

- Correct market failure

in many markets, there is a less-than-optimal allocation of resources from society's point of view so governments intervene to influence the level of production or consumption- In maximising their self-interest, firms & consumers will not self-correct this misallocation of resources & there is a role for the government

- E.g. Tobacco consumption is an example of market failure that the government has attempted to address by using indirect taxes to reduce consumption

- Earn government revenue

Governments need money to provide essential services, public & merit goods- Revenue is raised through intervention such as taxation, privatisation, sale of licenses (e.g. 5G licenses), & the sale of goods/services

- Revenue is raised through intervention such as taxation, privatisation, sale of licenses (e.g. 5G licenses), & the sale of goods/services

- Promote equity

Equity is a normative concept. Governments aim to reduce the opportunity gap between the rich & poor but the extent to which it occurs depends on what the society & government believe to be fair. Ways in which equity is promoted include:- Laws to protect workers e.g. minimum wage laws, health & safety laws

- Laws to prevent monopolies from forming as they result in higher prices

- Laws to prevent environmental damage

- Support firms

In a global economy, governments choose to support key industries so as to help them remain competitive. Ways in which they do this include:- Providing subsidies or tax breaks

- Limiting foreign competition until new firms are well established & are able to compete internationally

- Support poorer households

Poverty has multiple impacts on both the individual & the economy- Intervention through a range redistribution policies such as progressive tax structures & welfare payments helps to reduce poverty

- Intervention through a range redistribution policies such as progressive tax structures & welfare payments helps to reduce poverty

- Four of the most common methods used to intervene in markets are indirect taxation, subsidies, maximum prices, & minimum prices