The Role of Taxation

- The main source of government revenue is taxation

- Taxation is used to redistribute income so as to reduce income inequality in a nation

Types of taxes

- Direct taxes are taxes imposed on income and profits

- They are paid directly to the government by the individual or firm

- E.g. Income tax, corporation tax, capital gains tax, national insurance contributions, inheritance tax

- Indirect taxes are imposed on spending

- The less a consumer spends the less indirect tax they pay

- Examples of indirect tax include Value Added Tax (19% VAT rate in the European Union in 2022), taxes on demerit goods such as excise duties on fuel or cigarettes

Types of tax systems

- Tax systems can be classified as progressive, regressive or proportional

- Most countries have a mix of progressive (direct taxation) and regressive (indirect taxation) taxes in place

An Explanation of tax Systems

System |

Explanation |

Diagram |

|

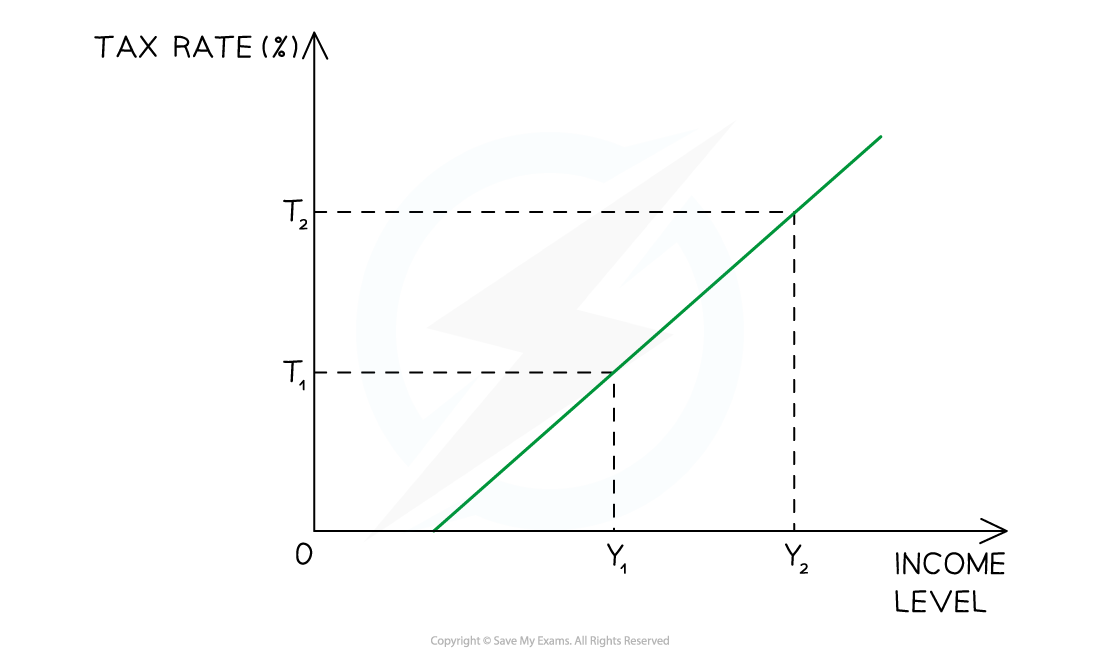

Progressive |

|

|

|

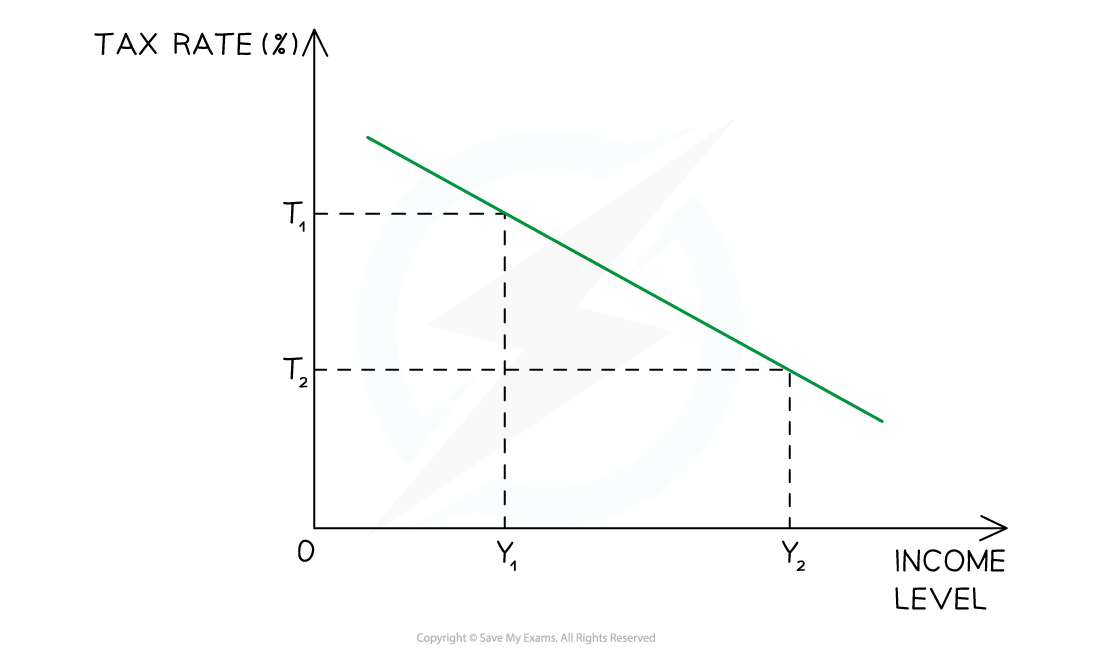

Regressive |

|

|

|

Proportional |

|

|

The link Between Taxation & the Reduction of Income Inequality & Poverty

|

Progressive taxation |

|

Higher redistribution → better education/healthcare → better human capital → better productivity → higher income |