Short-run Equilibrium

- Real national output equilibrium occurs where aggregate demand (AD) intersects with short-run aggregate supply (SRAS)

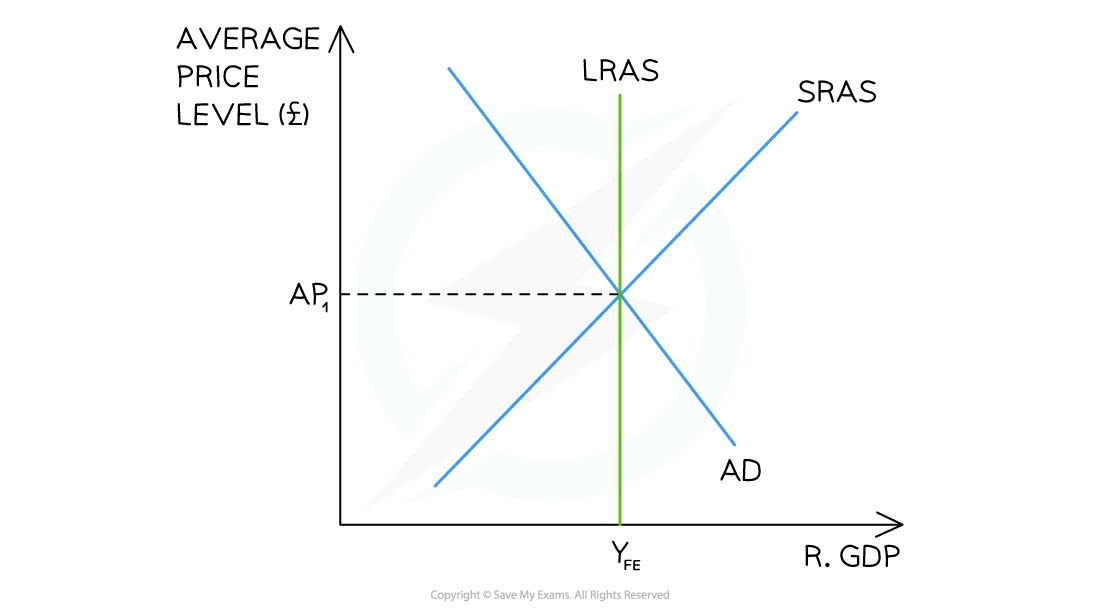

A diagram showing the Classical short-run equilibrium in an economy resulting in an equilibrium price of AP1 and real output of Y1

- According to classical theory, this economy is in short run equilibrium at AP1Y1

- Any changes to the components of AD will cause the AD curve to shift left or right creating a new short-run equilibrium

- Any changes to the non-price determinants of SRAS will shift the SRAS curve left or right creating a new short-run equilibrium

Long-run Equilibrium in the Monetarist/New Classical Model

- Classical and Keynesian economists have different views on the long-run equilibrium of real national output

- Classical economists believe that the economy will always return to its full potential level of output and all that will change in the long-run, is the average price level

- YFE is considered to be equal to the natural rate of unemployment in an economy

A diagram that shows the Classical view of long-run equilibrium which occurs at the intersection of long-run aggregate supply (LRAS), short-run aggregate supply (SRAS) and aggregate demand (AD)

Diagram Analysis

- The LRAS curve demonstrates the maximum possible output of an economy using all of its scarce resources

- The SRAS intersects with AD at the LRAS curve

- This economy is producing at the full employment level of output (YFE)

- The average price level at YFE is AP1

The Classical Adjustment Process (Self-correcting)

- Classical economists believe that in the long run the economy will always return to its full potential level of output and all that will change is the average price level

- This is the also referred to as the self-correcting mechanism

- This is the also referred to as the self-correcting mechanism

Automatic adjustment from a deflationary output gap

- A deflationary (recessionary) output gap occurs when the real GDP is less than the potential real GDP

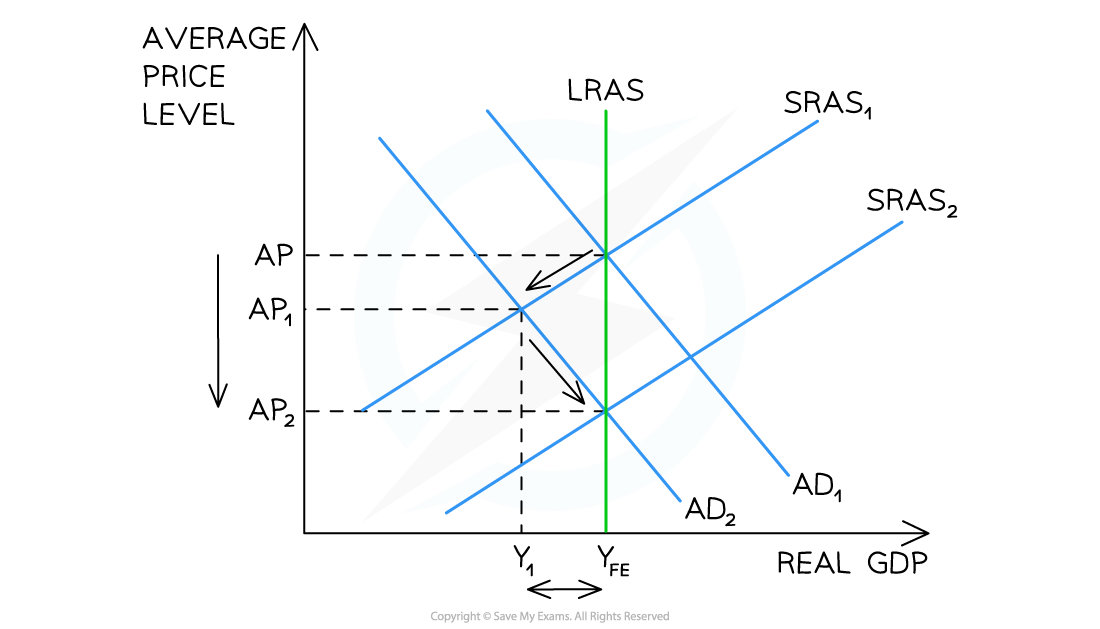

Aggregate demand (AD) has shifted left causing a deflationary gap, which in the long-run will self-correct to YFE but at a lower average price level (AP2)

Correction Process

- Initial long-run equilibrium is at AP YFE

- AD shifts left from AD → AD1, possibly due to the onset of a recession

- Output falls from YFE → Y1 and price levels fall from AP → AP1

- Due to the fall in output, firms lay off workers

- Unemployed workers are now willing to work for lower wages and this reduces the costs of production which causes the SRAS curve to shift right from SRAS1 → SRAS2

- A new long-run equilibrium is formed at AP2 YFE

- The economy is back to the full employment level of output (YFE), but at a lower average price

Automatic adjustment from an inflationary output gap

- An inflationary output gap occurs when real GDP is greater than the potential real GDP

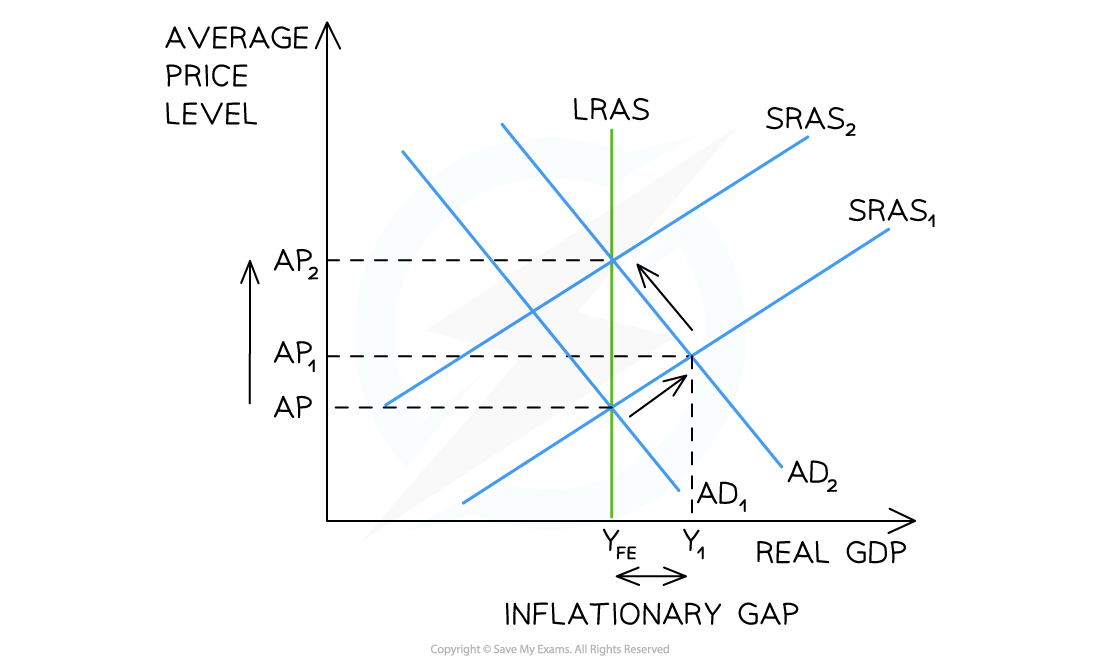

Aggregate demand (AD) has shifted right causing an inflationary gap, which in the long-run will self-correct to YFE but at a higher average price level (AP2)

Correction Process

- Initial long-run equilibrium is at AP YFE

- AD shifts right from AD1 → AD2, possibly due to raid expansion of the money supply

- Output rises from YFE → Y1 and price levels rise from AP → AP1

- Due to the increase in average prices (inflation), workers demand higher wages

- Higher wages increase the costs of production which causes the SRAS curve to shift left from SRAS1 → SRAS2

- A new long-run equilibrium is formed at AP2 YFE

- The economy is back to the full employment level of output (YFE), but at a higher average price

Equilibrium in the Keynesian Model

- Keynesian economists believe that the economy can be in long term equilibrium at any level of output

- The Keynesian view believes that an economy will not always self-correct and return to the full employment level of output (YFE)

- It can get stuck at an equilibrium well below the full employment level of output e.g. Great Depression

- It can get stuck at an equilibrium well below the full employment level of output e.g. Great Depression

- The Keynesian view believes that there is role for the government to increase its expenditure so as to shift aggregate demand and change the negative 'animal spirits' in the economy

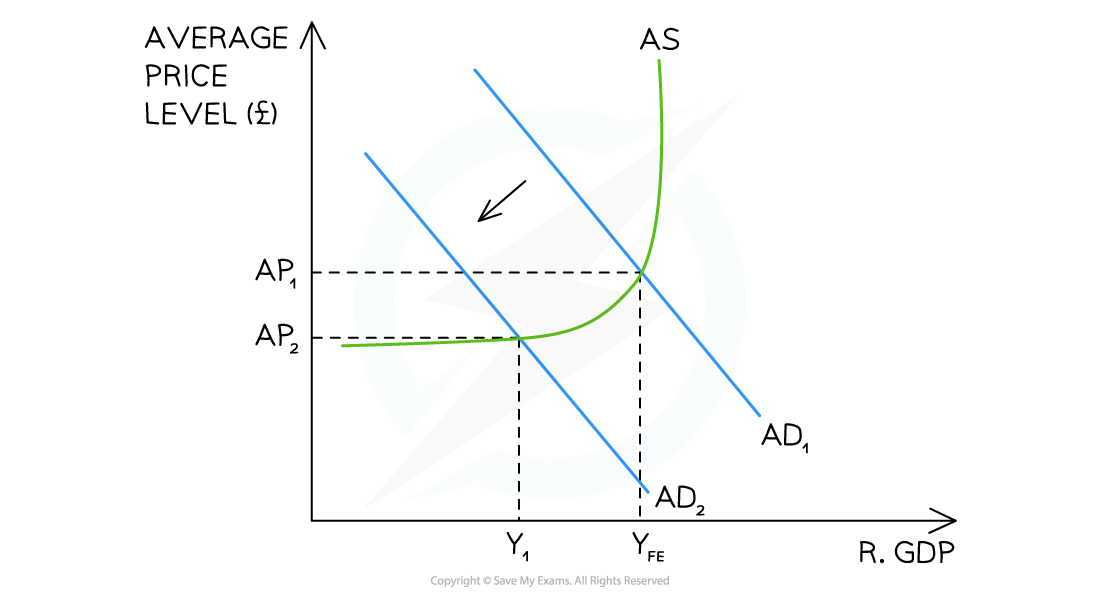

A diagram that shows the Keynesian View of aggregate supply (AS) with a vertical aggregate supply curve at the full employment level of output (YFE) becoming more elastic at lower levels of output

A diagram that shows the Keynesian View of aggregate supply (AS) with a vertical aggregate supply curve at the full employment level of output (YFE) becoming more elastic at lower levels of output

Diagram Analysis

- Using all available factors of production, the long-term output of this economy occurs at YFE

- The economy is initially in equilibrium at the intersection of AD1 and AS (AP1YFE)

- A slowdown reduces aggregate demand from AD1→AD2 and creates a recessionary gap equal to YFE - Y1

- The economy may reach a point where average prices stop falling (AP2), but output continues to fall

- Prices may be blocked from falling further due to minimum wage laws, the existence of trade unions, or long-term employment contracts preventing wage decreases

- This economy may not self-correct to YFE for years

- The low output leads to high unemployment and low confidence in the economy

- This stops further investment and further reduces consumption

- This stops further investment and further reduces consumption

- Keynes argued that this was where governments needed to intervene with significant expenditure e.g. Roosevelt's New Deal; response to financial crisis of 2008

Assumptions & Implications of the two Models

- Each model has strengths and weaknesses

- It has been said that free market fans like Classical thinking when an economy is doing well but very quickly switch to a Keynesian way of thought during severe recessions as they seek government bail outs

- The Economist Mariana Mazzucato sums it up with the phrase, 'Capitalists like to privatise their profits and socialise their losses'

The Assumptions & Implications of Classical Thinking

| Assumptions |

Implications |

|

Wages are flexible |

|

|

Any deviation from YFE is temporary |

|

|

Demand-side policies are less effective than supply-side policies in generating economic growth |

|

The Assumptions & Implications of Keynesian Thinking

| Assumptions |

Implications |

|

'In the long-run we are all dead' |

|

|

Wages can be inflexible 'sticky' downwards |

|

|

Governments have to intervene to break the 'negative animal spirits' |

|